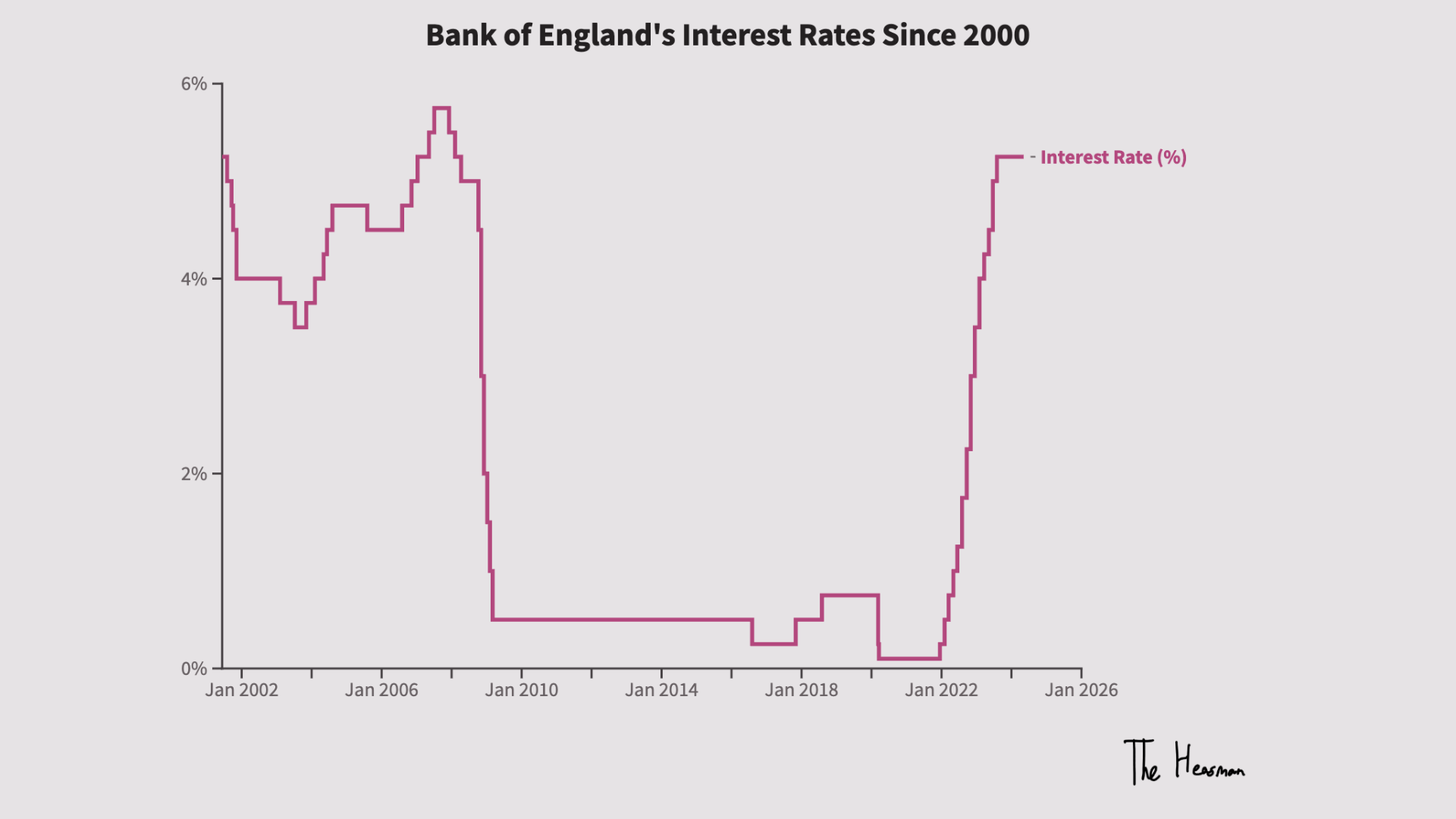

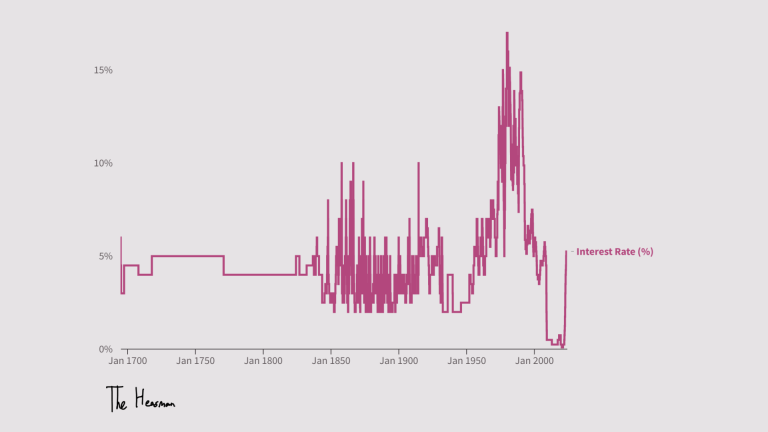

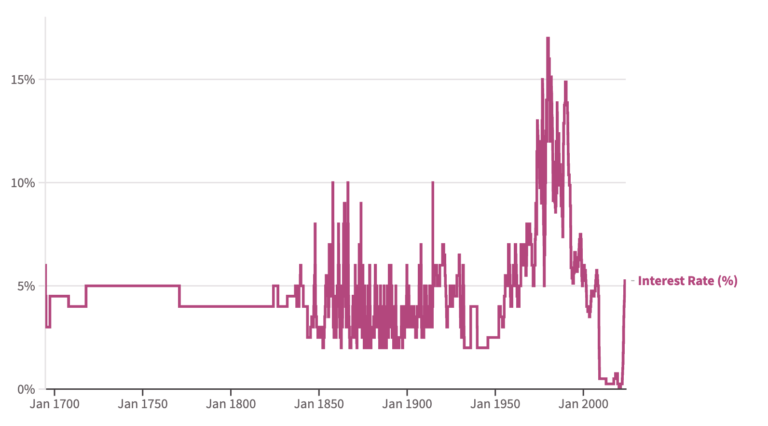

After nearly a decade of rock bottom interest rates, the Bank of England (BoE) rapidly raised interest rates to combat inflation. This data essay looks at three key interest rate regimes since 2000.

The Bank of England announced that they are holding interest rates at 5.25% today.

For some perspective, here’s a data story looking at England’s interest rates since 2000:

You can view the data story in full screen by clicking here.

The Key Interest Rates Regimes since 2000

A lot of economic history, and interest changes have happened in the UK since the start of the millennium.

As the proverb goes “may you live in interesting times”. Here are the distinct ones.

Interest Rates During The Dot Com Bubble (2000)

Ah the dot-com bubble. I have memories of my uncle paying nine-year-old me, a whopping £1 to read the paper each day to look out for potentially hot technology companies, so he could speculate on the stock markets.

To do a brief recap – the late 90s was fuelled by a frenzied speculation on tech companies, because the internet was now a thing. It promised a new way of doing things, we could shop online, do our taxes online, and even watch television online…1For a great book that’s dated badly in a good way, I recommend Dot Con by John Cassidy. Written just after the crash, its pessimistic about the internet and throws scorns on the promises that investors fell for, including a certain Reed Hastings of Netflix discussing the promise of streaming TV shows in the year 2000. A fascinating read, and proof of the theory that speculation booms and bubbles fuel the infrastructure required for the next generation of technology to build solid businesses around. The dot com bubble was wild, but without it, you wouldn’t be reading this footnote right now.

Yahoo!, AOL, Google, Amazon, eBay, Paypal – all these businesses were built during the dot com bubble, and are still around today. But the good times ended when a website called pets.com had to shut down, despite massive brand presence, because it didn’t turn a profit.

Stock markets collapsed, and these affected global markets. The Bank of England lower interest rates from 5.25% to 5% amid concerns of a UK economic slowdown, following the crash.

Interest Rates During The Financial Crash (or sub-prime mortgage crisis) (2007)

2000 to 2007 was fuelled by rising property prices, and abundant credit to achieve the British/American dream of homeownership. In the UK these were the days of 125% Loan-to-Value mortgages2http://news.bbc.co.uk/1/hi/business/7256903.stm, where banks would loan you money to buy a house plus extra. Ah the good days.

In the US, to cut a very long story short3Read The Big Short by Michael Lewis if you haven’t already for an explainer on what caused the financial crash. The movie is excellent too , the consequences of NINJA loans started to bite. NINJA loans stood for “No Income No Job and no Assets” mortgages. Yuppp loans were given to high risk borrowers who held no collateral or prospects to payoff the mortgage. These were sold at an attractive low rate for the first few years of the loan, and then the interest rates were jacked up.

Brokers didn’t care, because there were some wild incentives at play.4Okay okay okay. Look. I can’t do this justice in a footnote but here goes. There was some mad money to be made if you packaged up these risky loans, and then sold them on to another buyer. This would be done by selling them as low grade bonds. America has a AAA credit rating, so it’s bonds are AAA bonds. Large corporations have a BBB+ so they get BBB+ ratings. The lower the credit rating, the higher the return that bond buyers can expect, because, low credit means more risk. These bonds were called “junk bonds”, which were rated as BB+ or lower, and offered attractive returns.

Some savvy traders figured out you could hedge your bets when you bought these loans doing something called Collateral Debt Obligations (CDO’s), and this is where my knowledge starts to get hazy, because I’m typing this in a cafe with a deadline, and I don’t have time to be google sleuthing like mad. But you can lump CDO’s with that little term we all became familiar with after the financial crash – “derivatives”. But anyway, you could buy a high risk bond, and then you could hedge against it defaulting by buying insurance on it, called a CDO. Boom. As a trader you could make easy money doing this. And it worked! The problem? No-one on earth knew how CDO’s worked. And no-one knew how risky the underlying mortgages were in these bonds.

CDO’s were a financial instrument which relied on derivatives, and whenever you rely on speculation as insurance, just think of it as sitting on a nuclear bomb. Think about the person who maxed out their credit cards buying crypto. They borrowed money to speculate. Works like magic when crypto is going up. When it goes down, suddenly your investment goes to zero, and you’re left with credit card debt. That’s called leverage. When you borrow to make money you are leveraging yourself. Works when things go up. Doesn’t work when things go down. It’s also why negative house equity is a horrible thing to happen, (and is rarely talked about during the quest for homeownership, because the default wisdom to become wealthy is don’t leverage yourself, but buying a house is an arguable exception to this).

But, the derivative traders who were packaging these CDO’s? They were making money. Serious money. The incentive was to hit your quarterly target, and you could get six to seven figure bonuses. Life was good.

Again. The problem? No-one knew or cared about the risk that these bonds posed. Bonds didn’t have the same risk perception that stocks did. It was a lovely piece of attractive packaging.

All these meant serious incentives were at play. The derivative traders were selling CDO’s like they were water. The traders buying bonds and hedging with CDO’s were making solid, steady, and predictable returns for their investors (promise a pension investor that you can give him 12% returns based on solid assets, and he will give you an hour of his time, even if you’re dressed in rags and look like John the Baptist. Okay, I’m exaggerating, but you get the picture). The people packaging these bonds, were also making good money, and the brokers who were making these predatory loans? They not only made money on the loans, but were given commissions by the people packaging these bonds.

So, can you imagine what happened when those No Income, No Job, and No Assets borrowers started defaulting on their loans, when the sky high interest rate kicked in?

Those bonds that everyone thought weren’t that risky, suddenly were risky. The traders started selling their CDO’s. The derivative traders seeing the value of those CDO’s collapse, and insane margin calls started happening. (A margin call is when risks start going up, the cost of everything goes up, and you need more cash to maintain your position. Again. Key to wealth. Don’t leverage yourself. If you’re not leveraged, then you don’t get margin calls. Period. If you can’t pony up the cash, well you better enjoy something called bankruptcy.)

One bank that was very exposed to this form of speculation was Lehman Brothers….. But then when the interest rates for these predatory loans went up, and borrowers started defaulting, the sub-prime mortgage crisis began. Markets that were exposed to mortgage borrowing started being affected, and new financial instruments meant that companies were more exposed than they realised.

Lehman Brothers were heavily exposed to the mortgage market, and suffered a heavy5Understatement. “Unprecedented” is the language used for their loss loss in 2008. It’s stock price dropped heavily, dragging the entire stock market down with it. After a failure to bailout the bank, Lehman Brother’s declared bankruptcy with $600 billion in assets.

This triggered the financial crash.

The Bank of England initially weren’t worried about the financial crisis. And then suddenly. They were.

And so begins an unprecedented era in modern financial history. An era of cheap credit, as interest rates plumment to near zero, and quantitative easing is used, to ensure cash flows around the economy, to stave off a heavy recession.

Brexit (2016)

If I wrote a section on quantitative easing and low interest rates, this blog post would become a book. But to illustrate this with a metaphor we’re all familiar with…

If there is a lot of cash swirling around an economy, inflation happens. Lots of cash? Prices go up, because demand goes up. Quantitative easing and low interest rates were a form of stimulus to provide the economy with lots of cash.

Inflation didn’t go up. Economic growth barely happened.

But things slowly changed. A new normal had begun. And a near decade of a lack of economic growth, had, along with other things spurred populist movements across the world.

On 23 June 2016, the UK voted to leave the European Union. Foreign exchange speculation ramped up, and the exchange rate for the £ to the $ and the £ to the € was falling. This would push up inflation in the short term, so the Bank of England intervened with a swiss army knife of interventions to buffer the economy against such a shock.

The populists tried to get the then Bank of England governor Mark Carney to admit his actions were irrational and would just spread fear in the markets6https://www.ft.com/content/3209bb94-57a3-38ac-af76-addf4a3a9307. Mark Carney became an overnight silver fox with his reply that he was “absolutely serene”7You can watch the clip to the Treasury Committee here https://www.bbc.co.uk/news/business-37299838. He also said he was “absolutely serene” to a press conference about the British economy.

Damn, who knew Economics could be a sexy profession? I studied the wrong degree.

Interest Rates In The Post Covid Era (2021-2024)

Inflation Cause Number One – Everyone has cash

Let’s just skip past the scramble to leave the EU, the Boris Bounce, Covid, furlough payments, “eat out to help out”, and the rollercoaster of clapping for the NHS, lockdowns, and the amazing news of the vaccines being rolled out.

It’s October 2021. For a variety of reasons, inflation is starting to heat up. It breaks the 2% target for the first time since 2012, reaching 3%. Everyone is calm. Nothing to worry about. After all, central bankers were talking about changing the role of the central bank, from moving away of managing inflation, and to addressing economic inequalities?8I’ll never forget the wildness of these discussions. Proof that there was a younger roster of central bankers filling the ranks, who had never seen the horrors of inflation. Who had never heard of stories of people putting their house keys in the letter in the bank’s letterbox overnight with the words “sorry”, when interest rates had to skyrocket overnight to finally combat inflation. Your economic understanding is built on the economic environment you live and grow up in, and the curse of keeping inflation under control, was no-one ever thought it could happen.

Jesus Christ I’m still livid. Academia has got to get its act together, because some seriously dumb people have come out of certain institutions in the past ten years.

https://www.economist.com/finance-and-economics/2021/07/10/the-pandemic-has-widened-the-wealth-gap-should-central-banks-be-blamed

https://www.economist.com/special-report/2022/04/20/when-central-banks-become-one-stop-policy-shops

https://www.lse.ac.uk/school-of-public-policy/events/2023-24/Should-central-banks-have-an-equality-mandate

Inflation? That was a thing of the past. Like war. It will never happen.

December 2021. Inflation is rising. It reaches 4.8%. The Bank of England raises rates for the first time since the Pandemic from the near zero 0.1% to 0.15%. Why? Because of inflation. “The MPC’s remit is clear that the inflation target applies at all times, reflecting the primacy of price stability in the UK monetary policy framework.”

Inflation Cause Number Two – Russia Invades Ukraine

The unthinkable happens. The US intelligence was true, despite many European leaders being in denial – Russia invades Ukraine on the 24th February 20229https://www.bbc.co.uk/news/live/world-europe-60454795.

Russia is not only a large provider of energy to Europe, but is also a large supplier of food commodities (sunflower oil, for example). Ukraine is a large provider of other food commodities such as oil, and wheat.

Commodities price rise, as war threatens trade and transportation. This adds to inflationary pressures. The Bank of England raises rates from 0.5% to 0.75%.

Inflation Cause Number Three – Trussonomics and the Lettuce

Inflation is rising, because of the above factors. On the 21st September 2022, the Bank of England continues to raise rates, from 1.75% to 2.25%, making those with mortgages increasingly concerned that their mortgage payments could double within a few years.

Two days later. Two days later. Two frikking days. Kwasi Kwargeng unveils his “Growth Budget”10https://www.gov.uk/government/speeches/the-growth-plan-2022-speech. The greatest piece of economic kamikaze a developed economy has undertaken.

Two days. This was further proof that the Chancellor’s office was not talking to the central bank, nor with the Office of Budget Responsibility.

The mini budget, was a plan to use heavy tax cuts to stimulate investments in the UK economy. The problem is, as a government, especially if you have a high debt-to-GDP ratio, like the UK does, if you’re going to cut taxes, you need to demonstrate where you will get the money for it.

Liz Truss and Kwasi Kwarteng? No. The rules didn’t apply to them.11https://www.politico.eu/article/liz-truss-prime-minister-tory-conservative-westminster-tax-cut-economy-budget-sunak/

https://www.theguardian.com/politics/2022/sep/13/focus-on-growth-not-fiscal-discipline-kwasi-kwarteng-tells-treasury

These tax cuts were going to be unfunded. And how will the UK treasury recoup the money lost on these tax cuts? Why, the gains from future growth of course!

The markets were having none of that.12An excellent summary of the mini budget disaster can be found on the BBC written by Faisal Islam https://www.bbc.co.uk/news/business-66897881. The rate at which banks were borrowing to provide mortgages suddenly went up, and home buyers were having their mortgage offers withdrawn overnight. The next offers they were seeing were two, three, four percentage points higher, making their mortgages unaffordable.

The political backlash was brutal. (Liz Truss’s regime lasted less than a lettuce13https://en.wikipedia.org/wiki/Liz_Truss_lettuce that was posted online when she gained power.) But the economic backlash? Even more brutal the Bank of England had to raise rates by 0.75% at its next meeting.

Why? Inflation was now at an eye bleeding 9.6%.

“There have been large moves in UK asset prices since the August Report. These partly reflect global developments, although UK-specific factors have played a very significant role during this period…” (emphasis mine).

The most British way of the MPC saying, UK asset prices moved significantly because of the mini-budget disaster.

A cooling off in inflation? Low interest rates on the horizon? (2024)

Since August 2023, when interest rates reached 5.25%, the Bank of England has maintained rates at that level, not raising them any further.

Aiming for a soft landing, keeping inflation in check, while not triggering a recession, the Bank of England has fought to keep interest rates at a delicate balance.

On 9 May 2024, the Bank maintained rates, despite inflation now at a low of 3.2%, and forecasted to hit the target 2 to 2.5% later this year (but rise again in the winter).

Hopefully this is the beginning of the end of the cost-of-living crisis, and a return to normal interest rates.

However, I don’t think we’ll see the era of low interest rates again for a while. Maybe they’ll drop to 4%, or 3.5%. But not 1%.