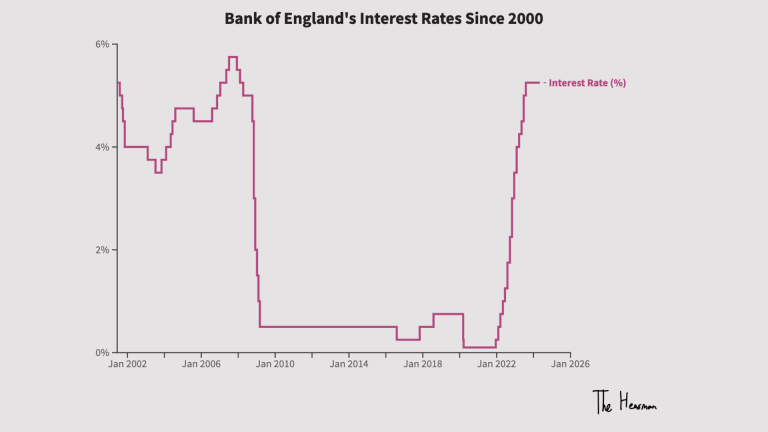

The Bank of England (BoE) has announced today that interest rates will be held at 5.25%.

A reminder – from the middle to late half of the 20th century, when we moved from the era of John Maynard Keynes1A very smart economics graduate told me that during this era, the goal was zero unemployment, as opposed to keeping inflation in check. I also know that I’m not an economist, and the more I read, the less I understand. So perhaps, I’m wrong. to the era of Milton Friedman, interest rates were used by Central Banks to keep inflation in check.

Keep it low, everyone borrows money like crazy, and we experience economic growth. But then prices and wages can rise like crazy if there isn’t a correction (that’s the fancy term for what can either be an economic crash or the burst of an economic bubble. Ah tulips).

Keep it high, and everyone hoards their money in their bank accounts, watching it grow with interest. But then people don’t invest in companies or businesses – not much economic growth.

It’s a tight balance. Keep it low and you can get a wage-price spiral nightmare (Weimar Republic, Argentina, Venezuela). Push it too high and you can get a recession and people are out of work.

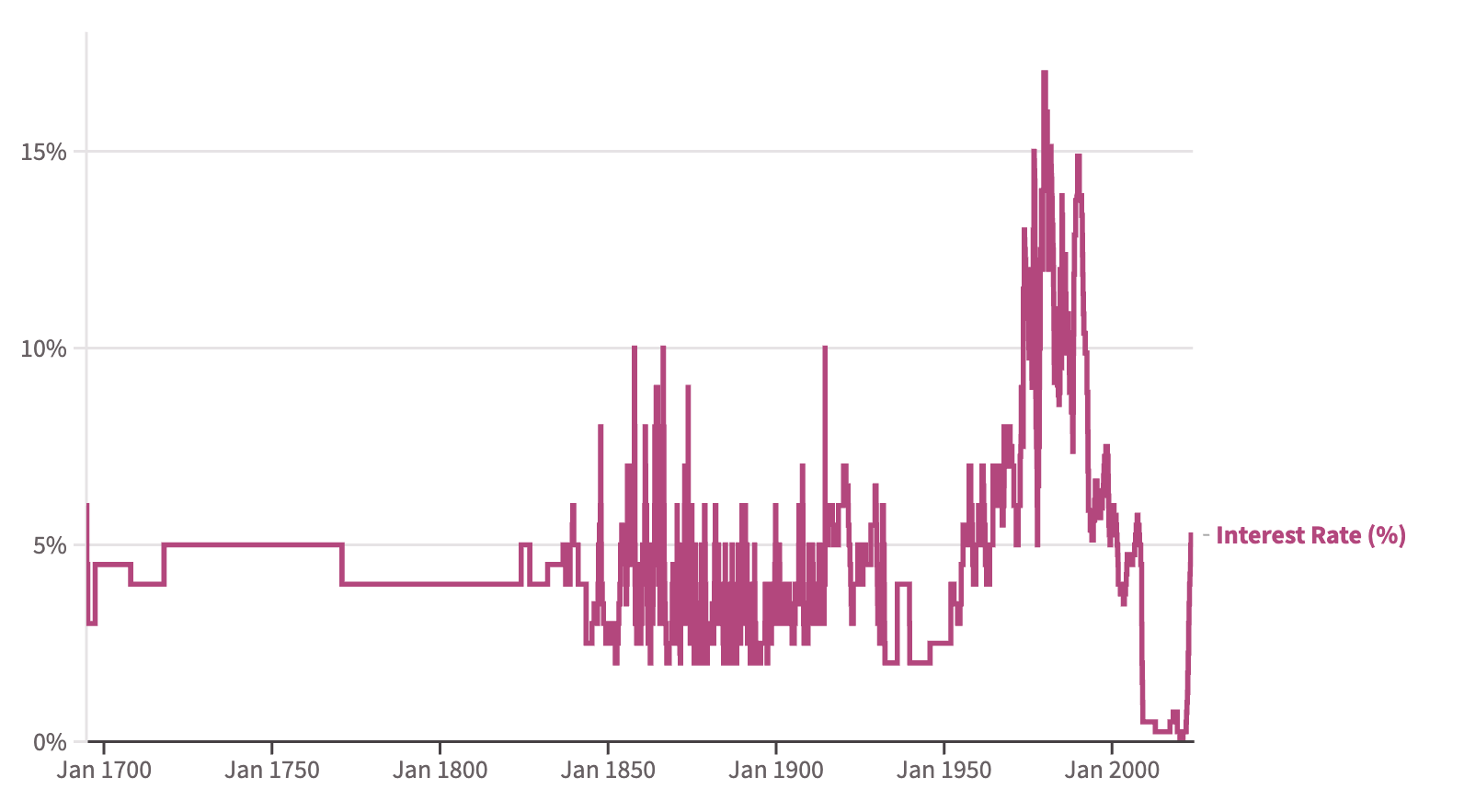

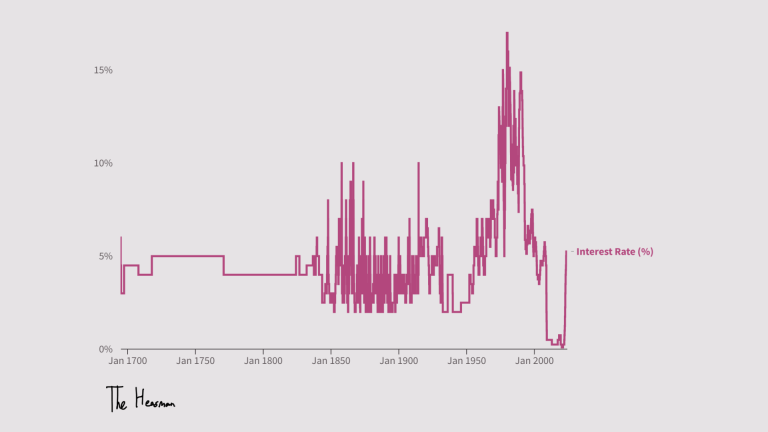

This instrument, interest rates, has been around in England since 1694.

(You can view the chart as an interactive in full screen by clicking here)

In 1694, back when England was doing that whole fight wars against all of Europe thing, the government needed cash. So it set up an entity called “The Bank” and asked the Bank to loan the government £1.2 million. (This loan was finally paid off in July 1994.)2I am simplifying for dramatic effect.

What I love about this chart, isn’t just being able to nerd out over economic history, but it clearly shows that the era of low-interest rates was unprecedented and unique.

Being able to borrow money at a 1% interest rate was an era no modern economy has ever seen. It led to business models that are now being challenged (tech for instance can’t get financing on a pure growth basis). New builds which look like they can be found in Manchester, Chicago, or Switzerland. And potentially, three periods of cryptomania.

But back to the present.

Interest rates being held at 5.25% is good news. It doesn’t feel like it, but it is. For the first time, the BoE has signalled that it is ready to consider cutting rates. And it didn’t say anything about “further tightening might be needed”.

Inflation is now at 4%, compared to that crazy high of more than 11% when a lettuce lasted longer than a Prime Minister. But inflation isn’t yet at the target of 2%. And the most optimistic forecasts put it happening in two years.

One thing is clear though – the era of low interest rates? Don’t expect that coming back in a few years time.

Me personally? I’m not expecting it ever again.

I’m releasing a newsletter next week exploring the data behind our everyday lives in London and the UK. The first story is going to be a three-part deep dive on rents, house prices, and affordability.

You can get notified when it is available by signing up here.