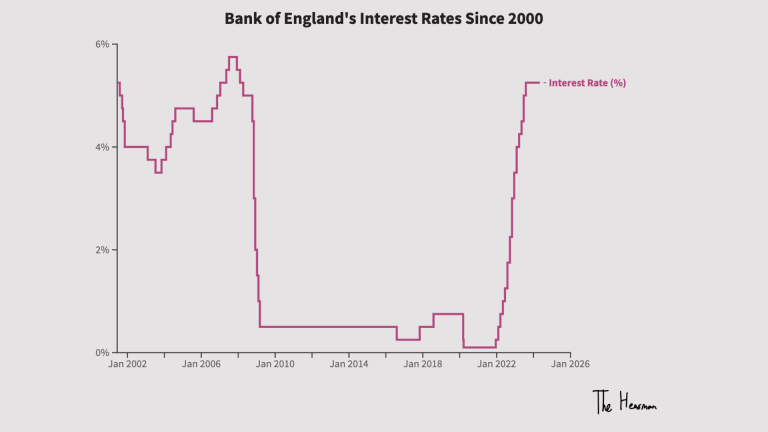

A Data History of UK Interest Rates

Lets look at a history of interest rates in the UK (or England…)

Interest rates in England began in 1694. The government needed to raise money to rebuild the Royal Navy in the Nine Years’ War. It set up an entity called “The Bank” and asked it for a loan of £1.2 million.

This is how the Bank of England was formed.

(The loan was finally paid off in 1994).

In over 300 years of UK interest rates and economic history, we can see rates have been high, and rates have been low. (Though the lowest has been in recent memory)

But lets zoom to our era of economic history.

From the Year 2000…

It is the turn of the milennium, Britpop is at its height, fears of the Y2K bug didn’t come true, and the dot com bubble finally bursts.

Because of concerns of a UK economic slowdown, the Bank of England’s (BoE) Monetary Policy Committee lowers interest rates

A hop, skip, and a jump to 2007. Steve Jobs unveils the iPhone, The Spice Girls re-unite for a tour, and we all start yelling “THIS IS SPARTA!” after watching 300.

Also, there is the foreshadowing of a financial crash. House foreclosures begin in the US, and there is a tightening of household credit in the UK.

Rates are slowly lowered.

Then the unimaginable happens on 15 September 2008. After a radical devaluation of its assets, Lehman Brothers, a 150 year old investment bank goes bust. The US govt refuses to bail it out.

The US Treasury believes the effects will be contained…

A special Monetary Policy Committee (MPC) meeting is called.

The UK govt co-ordinates with other G8 countries, and drastically drops rates. A program of quantitative easing begins. Most people (including me) still don’t fully understand what that is.

From 2009 we have our era of low interest rates and quantitative easing. Or “cheap money”.

Other features include UK (and Europe) austerity; a Euro sovereign debt crisis; and a tech boom in the US.

Brexit – 23 June 2016. No need to say more.

In the aftermath of Brexit, The BoE introduces a slew of measures to cushion the UK economy after fluctuations in Sterling. Mark Carney makes economists sexy again after he says the “British economy is serene” to the Treasury Select Committee.

March 2020.

Covid.

The BoE cuts rates and introduces further policy measures to prop up the economy during lockdown.

December 2021. The BoE raises rates for the first time since Covid. Inflation is at 4.8%.

The story starts to ramp up here…

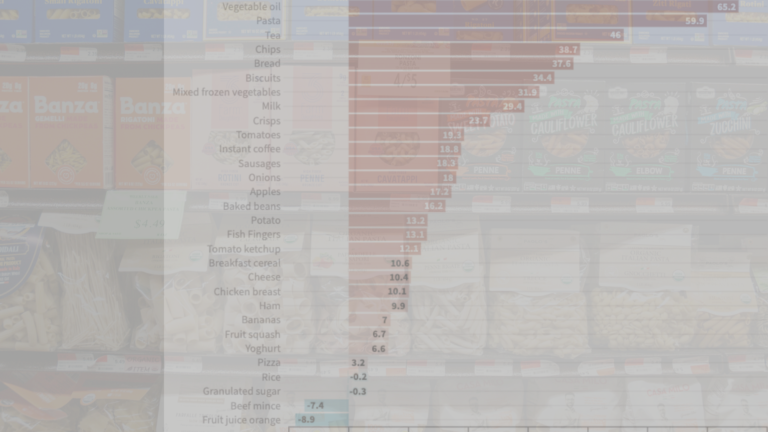

24 February 2022 – Russia invades Ukraine. Global commodity prices such as energy and food sharply rise. The Bank of England raises rates in March 2022.

In a twist of irony, the BoE meets on the 21st September 2022 and raises rates, because of the two inflationary tailwinds: a demand shock, and energy prices.

Ironic, because two days later, Kwasi Kwarteng unveils his “growth plan” (or what I call a piece of economic kamikaze), borrowing a lot of money to enable “growth” in the UK economy.

The plan is simple. Cut taxes with no plan to balance the books.

Where will the govt get money to pay for stuff? Why well they’ll borrow the money in the short term, and future growth will balance things out.

What kind of growth you ask? Oh. That’s not their business. No need to have a plan for that. Growth will come.

The, uh, markets have something to say about the “growth plan” (or mini budget).

Mortgage rates spike as UK gilts (UK treasury bonds) rise drastically in price. The Bank of England raises rates, as while energy prices have stabilised, UK asset prices have risen due to “UK specific factors”.

The most understated economic commentary I’ve ever heard.

Inflation starts to slow (10.1% to 8.7%)

But wages are heating up – rising beyond forecasts.

Fearing a wage-price spiral, the BoE raises rates by 0.5%.

21 September 2023, mortgage holders and the entire country breathes a small sigh of relief.

For the first time since December 2021, when the MPC meet, they they do not raise rates.

They maintain the previous rate of 5.25%.

With a GDP contraction, and a loosening of the labour market, the signs of high rates are working. However, the economy is now cooling. The goal is to get a “soft landing”.

Cool down inflation, which means cooling the economy a bit, but don’t trigger a recession or high unemployment.

9 May 2024. The BoE continues to maintain rates. Inflation is down to 3.2% and is projected to be near its target in the next couple of years. However, fearing persistent inflation, the BoE doesn’t lower rates.

1 August 2024, the country breathes a deeper sigh of relief.

Interest rates are lowered for the first time since the cost of living crisis began.

The soft landing is in sight.

18 December 2025 – with inflation being 0.2% below forecasts, and continuing to fall, and unemployment ticking up to 5.1%, the Bank of England continues its gradual decrease of interest rates, lowering rates to 3.75%

Interest rates provide a fascinating window on economic history.

In our little window of time, interest rates play a big role in managing inflation, ensuring prices don’t rise out of control, and the economy keeps ticking.

The goal is for inflation to be kept at 2% to 2.5%. Where interest rates go will depend on economic matters inside the country

And geopolitical events outside the country.

Whatever happens… UK economic history will continue to be written with interest rates.

You can read a more in-depth history of interest rates from 2000 here.

Where will UK interest rates go?

I can’t guess that, but I can let you know when next they’re updated with my data journalism newsletter. Sign up now, and you’ll get my three-part data story on London’s Affordability Crisis.

Go one layer deeper

Sign up to read the exclusive three-part data story: London’s Affordability Crisis

Sign-up form not appearing above? Pesky javascript blocker… click here and scroll to the bottom for a vanilla boring mailchimp form that works on all devices.